Wednesday, August 31, 2022

By Jeff Velastegui, Founder of The Legacy Group, Personal Estate & Business Advisor

One of the main reasons people avoid reviewing or updating their estate plan is because they believe it means that they will be giving up control of their assets. This need for control can be a fear of running out of money, or it may come from misunderstanding what estate planning actually means.

Having an estate plan does not mean you give up control of your assets. The best way to be wealthy is to own nothing, yet control everything. Estate planning is a process that helps you do just that- protect, preserve and transfer wealth in the most tax efficient manner. Through careful gifting strategies you can still keep control of your income and save on future estate taxes.

In our previous article Estate Tax Exemption Changes Coming in 2026: Revisit Estate Planning Now I discussed the urgency of establishing your estate plan before the laws change. I mentioned a variety of advanced gifting strategies to help you take full advantage of lifetime gifting exclusions.

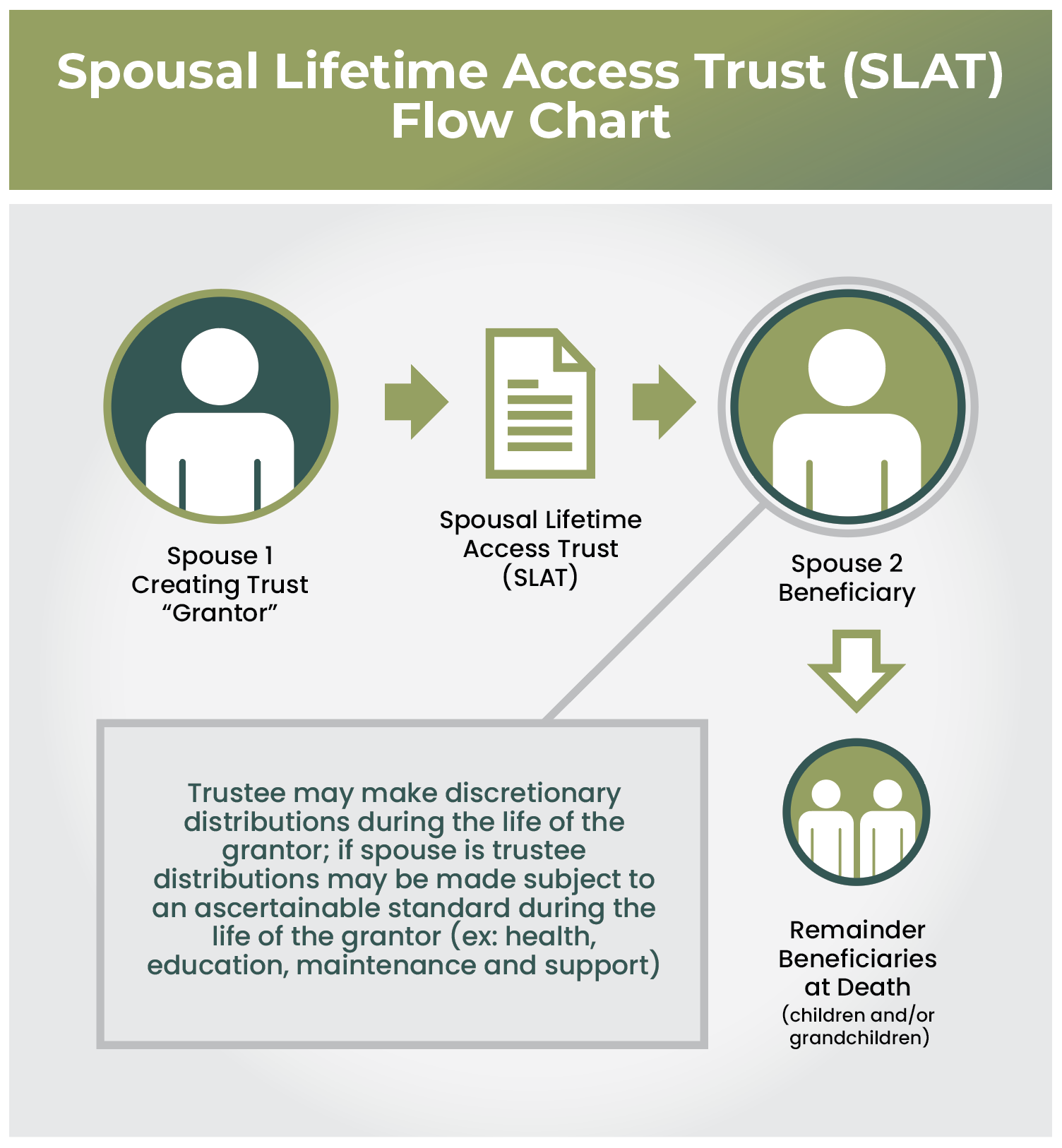

In this article, I delve deeper into a commonly used gifting strategy- a Spousal Lifetime Access Trust (SLAT).

What Is a SLAT?

A SLAT is an irrevocable trust used to move wealth outside of an individual’s taxable estate, yet still allow the donor/grantor indirect access to the assets through the noninsured spouse who is a lifetime beneficiary under the trust terms.

Here’s how a SLAT works: One spouse (donor/grantor) establishes a trust for the benefit of his or her spouse (lifetime beneficiary under the trust). Each spouse can create a SLAT for the other and family members, such as children and grandchildren. Careful consideration should be given when implementing SLATs to avoid violating the Reciprocal Trust Doctrine that states two spouses are not permitted to create identical trusts for each other.

Aside from the estate tax saving benefits, one of the most powerful features of a SLAT is that income and principal inside these trusts can be

distributed by a trustee to a beneficiary spouse during the grantor’s lifetime. These discretionary distributions can be used for many living expenses pertaining to health, education, maintenance, and support to maintain their standard of living. This is commonly referred to as HEMS provisions. In addition, beneficiaries may be given the right to withdraw the greater of $5,000 or 5% of the trust principal.

Additional Benefits of using a SLAT:

- If the SLAT is established as a Grantor Trust, any income generated by the trust can be reported on the donor’s tax returns. This allows the assets in the trust to continue to grow without distributions being made to pay taxes.

- A SLAT, like many irrevocable trusts, will generally provide additional protection against creditors.

- Any growth of the assets inside the trust will be outside of the estate of both the grantor and the spouse and pass estate tax free.

Is a SLAT Right for you?

Although there are many benefits to using a SLAT as a planning tool. There are a few reasons a SLAT, or any trust for that matter, might not be a good choice for you:

- If your spouse (beneficiary) prematurely dies, you lose the “indirect access” to assets inside the trust.

- If you divorce your spouse, the trust assets may become unavailable. Certain provisions can be included to remove the non-insured beneficiary spouse in the event this occurs.

When it comes to estate planning, there is no magic wand, silver bullet or one-size-fits-all solution. Careful consideration should be given when choosing an estate planning strategy. Understanding the short- and long-term impact of gifting is critical. Here are some things to consider before you make any gifts:

- Can I afford to give money or assets away?

- How will this gift impact my future cashflow?

- What do I want this gift to do for me and my family?

- Will I ever need that money in the future?

- Will there be any tax implications if I make a gift?

Having a clear understanding of your assets and how much you need to live comfortably for the rest of your life is a critical exercise that should be part of your estate planning process. Working with a team of advisors that understand the strategies, but also the financial impact of these is important. There are many complex planning strategies, and it can be difficult to determine which one is right for you.

Key Takeaways

People should not shy away from estate planning for fear of losing control of their assets. There are many advanced gifting strategies that allow a taxpayer to remove assets from their estate yet keep control. If you are looking to preserve and protect your legacy, a Spousal Lifetime Access Trust may be an effective planning strategy.

Contact the Legacy Group and let us help you find the right strategy that suits your needs. Email us at LegacyGroupNY@financialguide.com

—

Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. The Legacy Group is not a subsidiary or affiliate of MML Investors Services, LLC, or its affiliated companies. [6800 Jericho Turnpike. Suite 202 W Syosset, NY 11791 (516) 364-4203. Neither MML Investors Services, LLC [or MM if appropriate] nor any of its subsidiaries, employees or representatives are authorized to give legal or tax advice. Estate Planning services are provided working in conjunction with your Estate Planning Attorney, Tax Attorney and/or CPA. Consult them for specific advice on legal and tax matters. CRN202508-2908756