Monday, June 6, 2022

By Rob Capra, CFP and Jeff Velastegui, Personal Estate & Business Advisor, Founder & Owner of The Legacy Group

Many tax professionals in accounting offices across the country have had to deliver unexpected news to their clients this year about the capital gains tax increasing the amount of total taxes they owe. The big tax bills are not because of a change in their income or their deductions. Instead, a large capital gains tax is being triggered by their investments.

Suppose you are among the millions of Americans who save and invest in mutual funds outside of your qualified retirement plans (IRA, 401k, 403b, 457 plan). You may have noticed that you share in the burden of paying a little extra on your taxes this year because of the capital gains triggered by your investment selection.

Understanding The Capital Gains Tax And Mutual Funds

Direct from the IRS website is the definition of capital gains/losses: “When you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss” In plain English, if I buy an asset for $100 and sell it for $500 I have a gain of $400 and that gain is taxable in the year that I sell the asset.

What If I Didn’t Sell Any Investments?

Just because you didn’t sell any investments, doesn’t mean your fund manager didn’t. When you purchase a mutual fund, you are essentially hiring a manager to pick and choose those stocks for you. The manager’s job is to buy stocks they think will go up and sell ones they think have peaked or will go down. That’s an oversimplification, but I think you get the point. Fund managers buying and selling throughout the year create capital gains or losses. At the end of the year, shareholders are liable for the resulting capital gains tax. In some cases, it is possible to buy a fund, lose money and still owe a capital gain tax because the fund may have purchased some of their stocks long before you ever invested in them and had gains from that point. These taxable gains are called Phantom income.

Mutual Funds Explained

The idea behind a mutual fund is that instead of investing $1000 in Apple stock (APPL), you can take the same $1000 and invest in a mutual fund that owns Apple and 100+ other tech companies like it. A mutual fund in its simplest terms, helps you diversify your investment, and spread risk among many companies as opposed to owning just one. Mutual funds can cover all different asset classes and there are funds that invest in large companies, small companies, real estate etc. There are other factors to consider about mutual funds, such as fees and tax efficiency.

Why Tax Efficiency Matters in Your Non-Qualified Accounts

In a non-qualified account, you are responsible for taxes in the year that the gains are distributed, or the interest is earned. The type of account that you own an investment in will have an impact on when you pay taxes, in essence asset location matters! Robert Kiyosaki author of the book “Rich Dad Poor Dad” said “It’s not how much money you make but how much money you keep” so how do you get to keep more of what you made?

A big key to tax efficiency is having control over when you recognize the gains, not have them forced upon you. Choosing the right investment vehicle can help prevent unnecessary capital gains taxes. Working in conjunction with your accountant and financial planner can be the key to having a tax-efficient strategy. Below are some options to consider:

Index Mutual Funds

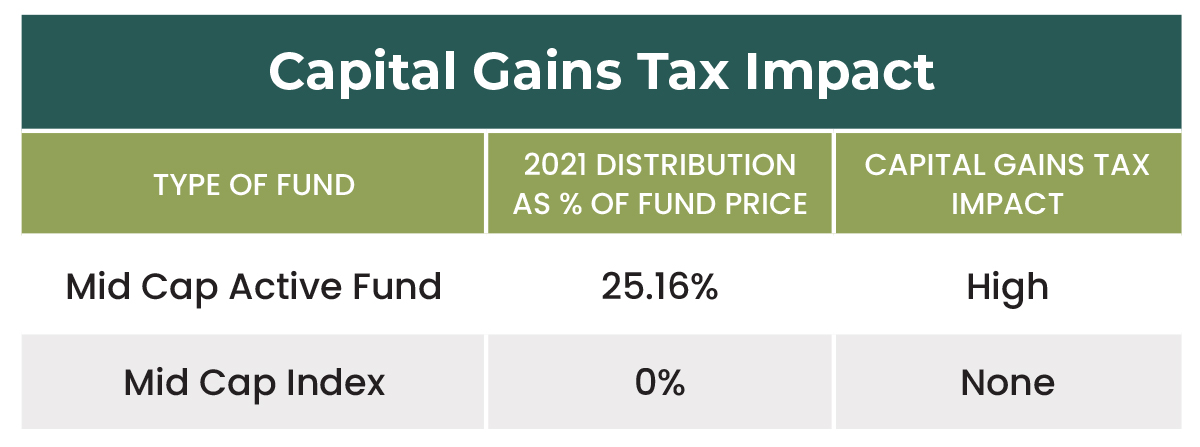

An index fund is designed to track and index such as the S&P 500 and because it tracks the index there is typically minimal buying and selling of positions. With the very low turnover there are generally little to no capital gains distributions paid out on an annual basis. There are index funds that cover almost all the major asset classes. So, if you own a US Large Cap mutual fund that is actively managed, and you want to maintain that exposure you could consider changing it for a US Large Cap index fund. Below is a comparison of a few actively managed funds that distributed capital gains over the past few years versus index equivalents. Using the index funds instead of actively managed funds provides investors a higher degree of control over when capital gains should be realized.

ETFs (Exchange Traded Funds)

An ETF is a great alternative to Mutual Funds. Unlike Mutual Funds, they trade in shares, and are bought and sold on a stock exchange like an individual stock. There are several types of ETF’s out there that track and represent almost any asset class that you can think of. The structure of an ETF allows it to trade like a stock and, as such, the gains are only realized on the final sale of the position. Many ETF’s also track indices but there are also actively managed ETF’s which will actively buy and sell positions within the fund but won’t pass the gains on to the shareholder. This makes ETFs an ideal option over mutual funds for non-qualified accounts because you can control the timing of when gains are realized.

Tax Loss Harvesting

An added benefit to using ETFs is Tax-Loss Harvesting. Tax-Loss-harvesting is the practice of selling investments at a loss, to offset capital gains on other investments that were sold at a profit. Another way you can take advantage of capital losses is to offset your ordinary income to a limit of $3,000 per year. While it never feels good to sell any positions at a loss, it can have its benefits from a tax standpoint.

If you decided to reinvest your cash after tax-loss-harvesting, make sure you understand the wash sale rule. This rule states that if you sell an investment at a loss, you cannot re-buy the same or a “substantially identical” investment within 30 days. The implication of violating this rule is that the losses you realized to offset the gains will not be valid and cannot be deducted. You could end up with a large capital gains tax bill. Working in conjunction with your accountant and financial planner to help implement this strategy can help to reduce your tax bill at the end of the year.

Contact us if you want to discuss tax loss harvesting strategies or different types of investments.

Key Capital Gains Tax Takeaways

Saving and investing for the future is always a good thing, as your income increases and your wealth begins to accumulate, there are several considerations that you must be aware of. The tax-efficiency of the investments you chose can have a significant impact on your bottom line. There are several strategies that can help mitigate the impact of a capital gains tax and improve your after-tax return on your investments. Working with your accountant and financial planner on a well thought out plan, taking into consideration asset location, investment vehicle selection, tax loss harvesting and optimizing your tax bracket can put you in a better position to avoid paying a capital gains tax and keep as much of what you make as you can.

Contact us if you want to discuss tax loss harvesting strategies or different types of investments. Email us at LegacyGroupNY@financialguide.com

—

Any discussion of taxes is for general information purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax or accounting advice. Clients should confer with their qualified legal, tax and accounting advisors as appropriate.

Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. The Legacy Group is not a subsidiary or affiliate of MML Investors Services, LLC, or its affiliated companies. [6800 Jericho Turnpike. Suite 202 W Syosset, NY 11791 (516) 364-4203 CRN202505-2430702