Monday, May 9, 2022

By Jeff Velastegui, Founder of The Legacy Group, Personal Estate & Business Advisor

Inevitable changes are coming to the current estate tax laws. These changes will have an immediate impact on the amount of estate taxes you will pay, but may also limit your estate planning options in the future. After two decades of working with families and individuals of closely held businesses, one thing is certain across the board: Your planning options are greater today than they will be tomorrow, and tomorrow is fast approaching.

In 2026, the current estate and gift tax exemption (also known as the unified tax credit), will be cut almost in half—and maybe more if Congress eventually succeeds in their attempts to make further drastic changes. This means that after December 31, 2025, your ability to pass on wealth (during your life or at death) will be dramatically reduced when the current estate tax provision sunsets. A larger portion of your wealth will be taxed at 40%.

The clock is ticking. Here is what you need to know and some planning options to consider.

Understand the Unified Tax Credit and the Upcoming Changes

The current estate tax exemption is $12,060,000 and double that amount for married couples. Individuals can transfer up to that amount without having to worry about federal estate taxes. This piece of mind, however, severely decreases after December 31, 2025.

When the calendar turns to 2026, the estate tax provisions implemented by the Tax Cuts and Jobs Act (TCJA) are due to expire or sunset. Unless your estate planning is completed and you have fully taken advantage of your lifetime gift tax exemption, the amount of wealth you can transfer during your lifetime reverts to the 2017 threshold (indexed to inflation), falling to about $6.6 million. Individuals and families who were previously not affected by federal estate taxes (the current rate is 40%) will now be subjected to this tax above the new estate tax exemption threshold.

But wait, there is more.

If you live in one of 18 jurisdictions that have state estate taxes, you could potentially lose even more of your wealth to taxes if you don’t implement proper planning. For example, the current estate tax exemption for New York is $6,110,000, with an estate tax rate ranging from 3.06 to 16%. For families with large enough estates, the effective combined estate tax rate (New York & Federal) can be greater than 40%.

The Impact of the Estate Tax Exemption Changes

Scenario #1:

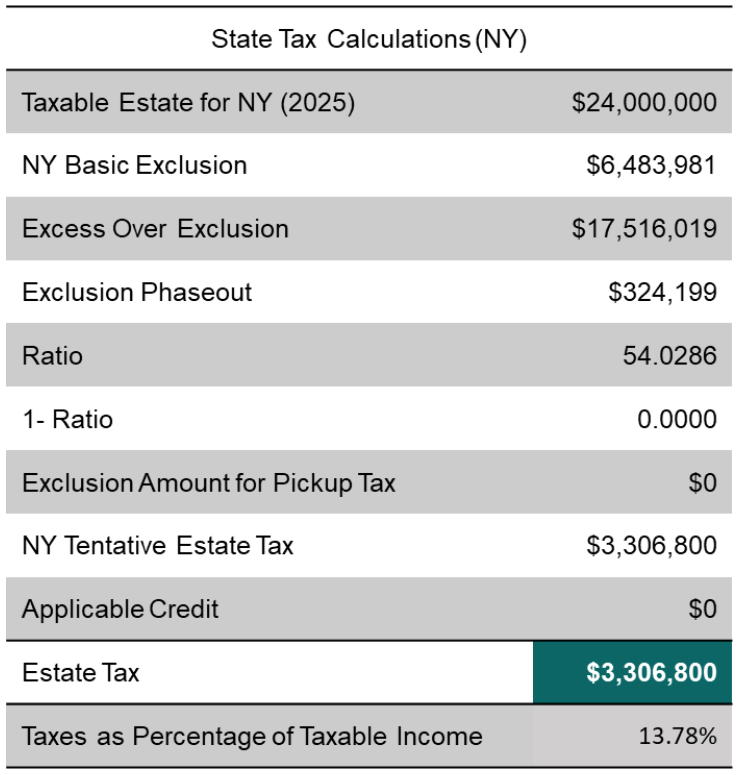

Under the existing estate tax laws, if the couple dies before 2026, they would not be subject to any federal estate taxes. Their estate would, however, still be subject to New York State estate taxes because their combined assets are above the New York exclusion threshold of $6,483,981 (in 2025). This couple would have to pay estimated New York State estate taxes of about $3,306,800 after applying the exclusion credits. Their heirs would receive $20,693,200 of their estate (assuming using a single spouse’s New York State exclusion).

Scenario #2:

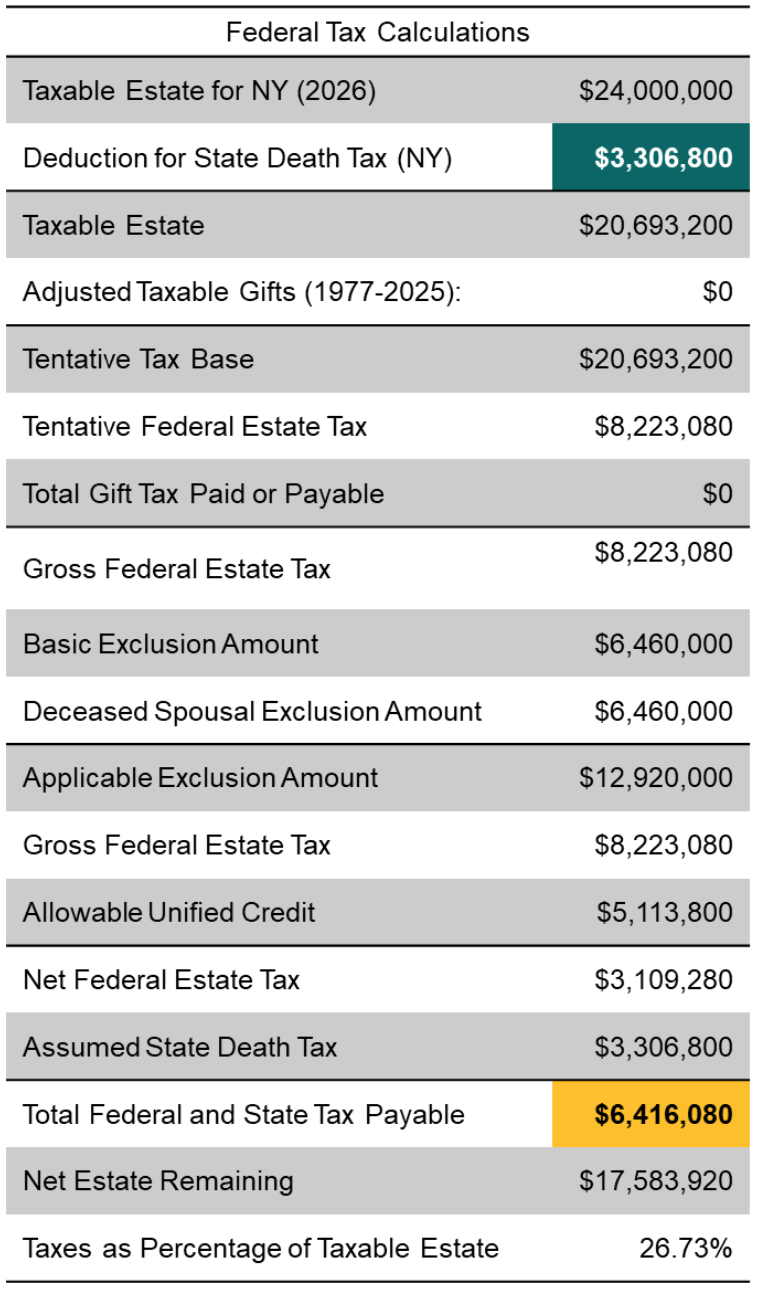

Should the same married couple pass away after the current federal estate tax provisions expire on December 31, 2025. The combined state and federal estate tax liability nearly doubles to $6,416,080. At this point, they can only exclude a combined $12,920,000 under the now lower federal estate tax exemption, which means that anything above this amount is subject to a 40% tax at the federal level. They can, however, deduct the $3,306,800 they paid to New York State reducing their taxable estate to $20,693,200 before applying their applicable exclusion of $12,920,000, leaving the remaining $7,773,200 to be taxed at a rate of 40%. Their heirs would receive $17,583,920, losing $6,416,080 to taxes.

Curious how much tax you will pay given your situation? My team can run simulations for you at no charge

Three Years Will Pass Faster than You Think—Don’t Wait to Update Your Estate Planning

You get no benefit by waiting and being part of the crowd rushing at the last minute. In fact, the problem may be compounding as assets continue to grow in your taxable estate. The most common reasons why people avoid planning is because they don’t want to lose control, they don’t think they can afford it, or, in some cases, they don’t have the right team or process in place to help them through their journey. The process of estate planning does not have to be complicated.

When working with clients, I always encourage a 3-dimensional planning process that ensures you make decisions with the collaboration of financial, legal, and accounting perspectives. Understanding your existing plan, desired goals, and objectives is critical before implementing additional planning.

Assuming you have done some basic estate planning (your will and ancillary documents), here some advanced planning strategies to help you take full advantage of the lifetime gifting exclusions ($12,060,000):

- Irrevocable Life Insurance Trust (ILIT): The death proceeds are generally included in someone’s taxable estate. An ILIT is specifically set up to own and receive the benefits of life insurance. Properly implemented, this trust ensures that the life insurance payments your heirs receive are free of income and estate taxes.

- Grantor Retained Annity Trust (GRAT): A GRAT allows a grantor to remove an asset from his or her taxable estate while still receiving income for a specific period. This technique has been particularly popular with business owners, including Sam Walton of Walmart and Mark Zuckerberg of Meta. Any growth above and beyond the original gift remains in the trust or passes to the beneficiaries.

- Sales to Intentionally Defective Grantor Trust (IDGT): Commonly used to sell an asset from a taxable estate, such as real estate, to a trust in which a person may retain some control. This sale does not trigger a capital gains tax because the trust is “defective” for income tax purposes (but effective for estate planning purposes). This type of plan will often create a stream of income back to the “seller” by holding a note equal to the value of the asset sold.

- Spousal Lifetime Access Trust (SLAT): This type of trust transfers wealth from one spouse to a trust for the benefit of the other spouse. If drafted properly, assets inside these trusts can be accessed during the beneficiary’s lifetime to provide for expenses pertaining to health, education, maintenance, and support (HEMS).

- Qualified Personal Resident Trust (QPRT): This is a type of trust that is used to remove the value of a personal residence from a person’s taxable estate. With this strategy the owner remains living in the home for a specified number of years. The retained interest in the home allows individuals to take a discount, which reduces the amount of the lifetime exemption used for this strategy.

Depending on your situation, one or more of the strategies above may be suitable for you. They are a great way to take advantage of the existing tax laws before they expire. The IRS has already stated that they will grandfather and recognize planning you do before 2026. Acting now will save your heirs millions.

Key Takeaways

No one likes to think about taxes. Thinking about death is possibly worse. But you do need to think about both if preserving your legacy for your loved ones is a priority. Failing to start or update your estate plan will inevitably lead to huge tax liabilities.

The deadline is fast approaching, and although three years seems like a long time, designing and implementing an effective estate plan requires time and cross-disciplinary collaboration.

It is critical that your team of advisors work together and understand your priorities so they can deliver effective and suitable planning options for your specific needs. If you do not currently have a team or want to explore another perspective on estate planning, call us at (516) 682-3383 or click below to schedule a complementary consultation.

—

Any discussion of taxes is for general information purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax or accounting advice. Clients should confer with their qualified legal, tax and accounting advisors as appropriate.

Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. The Legacy Group is not a subsidiary or affiliate of MML Investors Services, LLC, or its affiliated companies. [6800 Jericho Turnpike. Suite 202 W Syosset, NY 11791 (516) 364-4203

CRN202505-2177447