Thursday, November 17, 2022

By Jeff Velastegui, Founder of The Legacy Group, Personal Estate & Business Advisor

Annual exclusion gifting is perhaps one of the simplest estate planning strategies, and yet, it’s one that regularly gets overlooked. Taking advantage of your annual exclusion and implementing a gifting strategy can be an effective way to reduce the size of your taxable estate during your lifetime and is a powerful wealth transfer tool.

Unlike the Lifetime Gift Tax Exemption, annual exclusion gifts expire on December 31st of each year. As you prepare your year-end planning, leveraging this “use it or lose it” strategy can be the best thing you do this year.

Understanding the Rules

Every year the I.R.S. allows you to make gifts up to $16,000 in 2022 (increasing to $17,000 per year in 2023) to anyone and to as many people as you wish. Thus, married couples can give $32,000 in 2022 and $34,000 in 2023. If the assets are owned jointly by the married couple there are no forms or IRS paperwork if the gift is under the annual exclusion amount, however, gifts that exceed the annual exclusion threshold will count towards your lifetime gift exclusions and will require a gift tax return (Form 709).

As you consider your planning and gifting strategy, you should know that there are several “gifts” that are generally exempt from the rule and do not qualify as an annual exclusion or lifetime unified credit:

- Direct tuition or medical expenses for someone

- Gifts to qualified charitable organizations

- Gifts from one spouse to another

Generally, gifts are made in one of two ways: Outright or In-Trust. Outright gifts will generally qualify under the annual exclusion exemption because recipients have immediate and unrestricted access to such gifts; this is called a present interest gift.

Gifts made to an irrevocable (SLAT, ILIT, etc.) trust must allow for a present interest availability for the beneficiary. This is generally referred to as “Crummey Powers.” This power provides the beneficiary with the ability to withdraw their gift for immediate use and enjoyment. It does not matter how unlikely the exercise of this ability is, just that it is available to the beneficiary. This power customarily expires after 30 days. Every year a gift is made to a trust, a Crummey Letter should be provided to all the beneficiaries informing them of the gift and reminding them of their rights under the Crummy Power provisions.

As you begin to explore your planning options, one of the best ways to maximize annual exclusion gifts is by using an Irrevocable Trust.

Using Irrevocable Trusts to Leverage Annual Exclusion Gifts

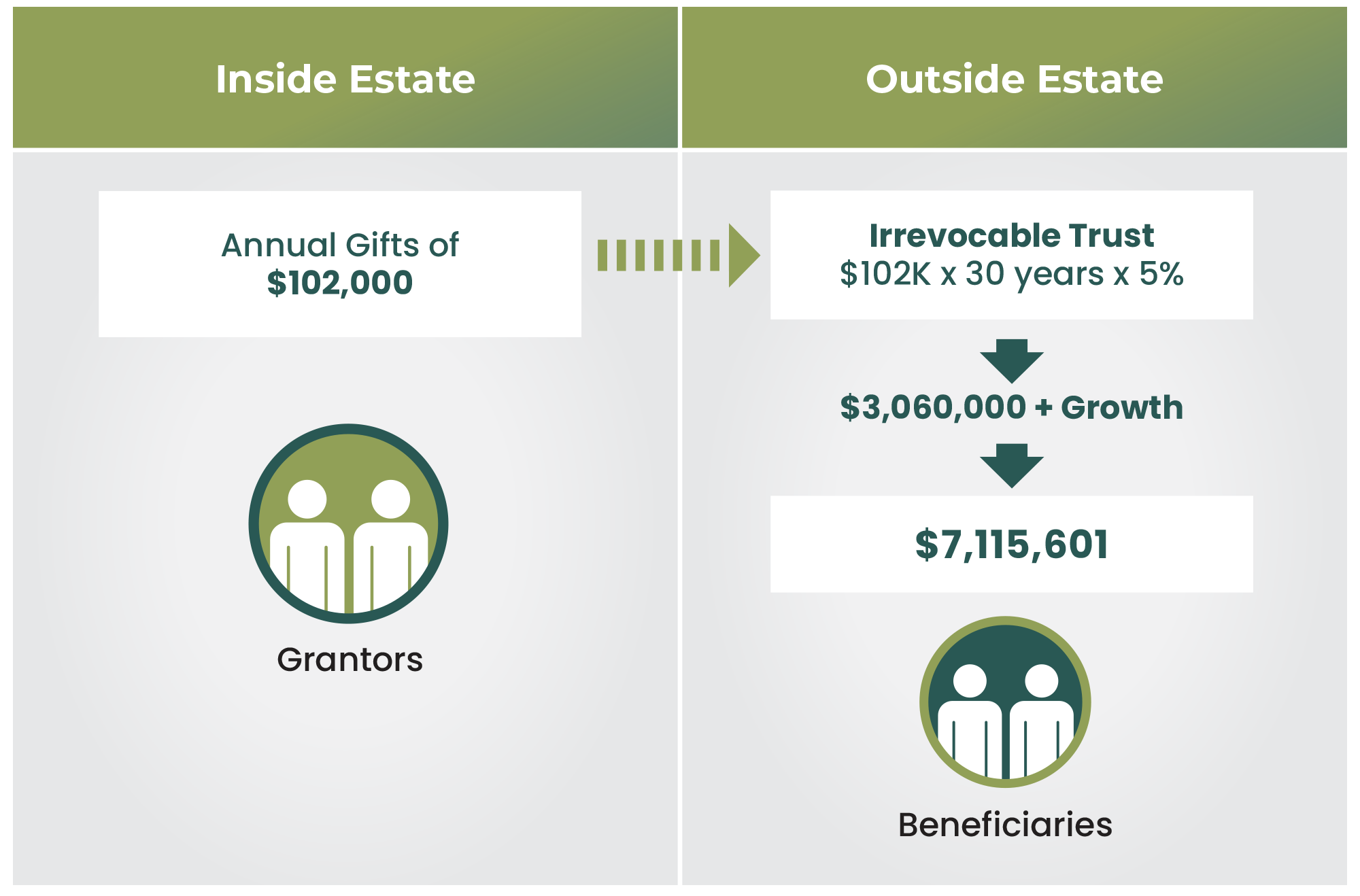

Depending on your situation and gifting capacity, there are several planning strategies where irrevocable trusts can complement and enhance your estate planning. Below is a comparison that will demonstrate the power of two gifting and planning strategies.

For both scenarios, let’s assume that a 60-year-old married couple (Grantors) with three children decides that they would like to maximize their annual exclusions gifts. Given their lifestyle and planning objectives, they feel comfortable making annual gifts of $102,000 ($34,000 x 3 kids) per year to an irrevocable trust for the benefit of their children and grandchildren (beneficiaries).

Scenario #1: Transferring Wealth and Investing Annual Exclusion Gifts During your Lifetime

There is a compounding effect that occurs if a family determines that they would like to create a larger intentional gifting strategy. As previously mentioned, if the grantors make annual transfers/gifts of $102,000 to an irrevocable trust over 30 years, these gifts can be worth approximately $7,115,601 assuming a 5% rate of return. Since those assets are held in an irrevocable trust, the cumulative gifts and growth of the asset happens outside of their taxable estate. If an estate is taxed at approximately 50%, the removal of $7,115,601 of assets will save the family $3,557,800 in estate taxes.

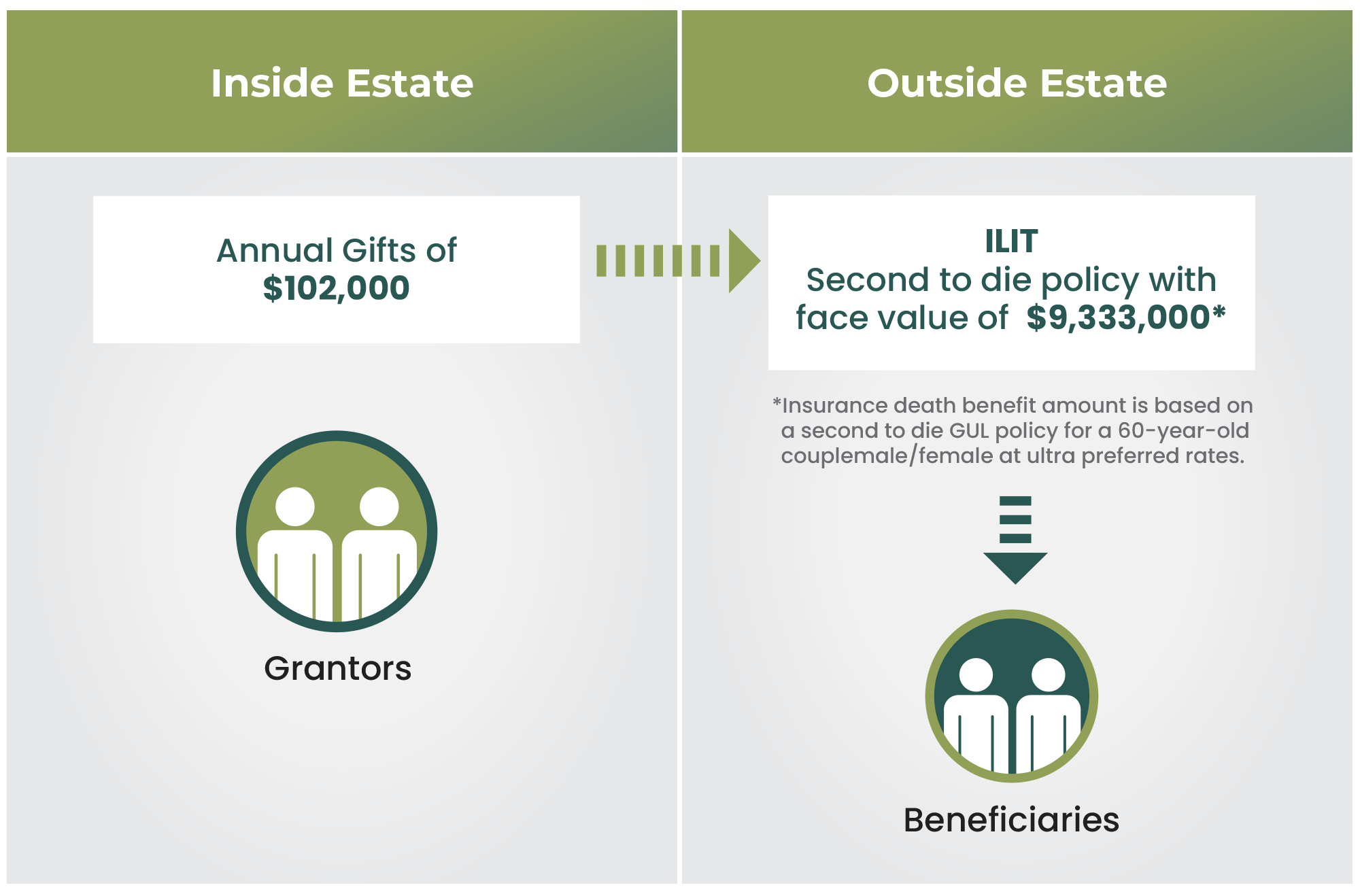

Scenario # 2: Making Annual Exclusions Gifts to an ILIT

An Irrevocable Life Insurance Trust (ILIT) is specifically designed to own and receive the proceeds of life insurance. When properly implemented, this trust ensures that the life insurance payments your heirs receive are free of income and estate taxes.

In this scenario, instead of investing the annual gifts over the life of the grantors, the $102,000 gift will be used to purchase a second-to-to-die life insurance policy inside the ILIT with a death benefit of about $9,333,000. One of the benefits of using life insurance is that the death benefit is immediately available in the event of an untimely death of the grantors.

As noted above, in both examples, because gifts were made into Irrevocable trusts, it is important to remember that Crummey letters/notices need to be provided to your beneficiaries every year that a gift is made.

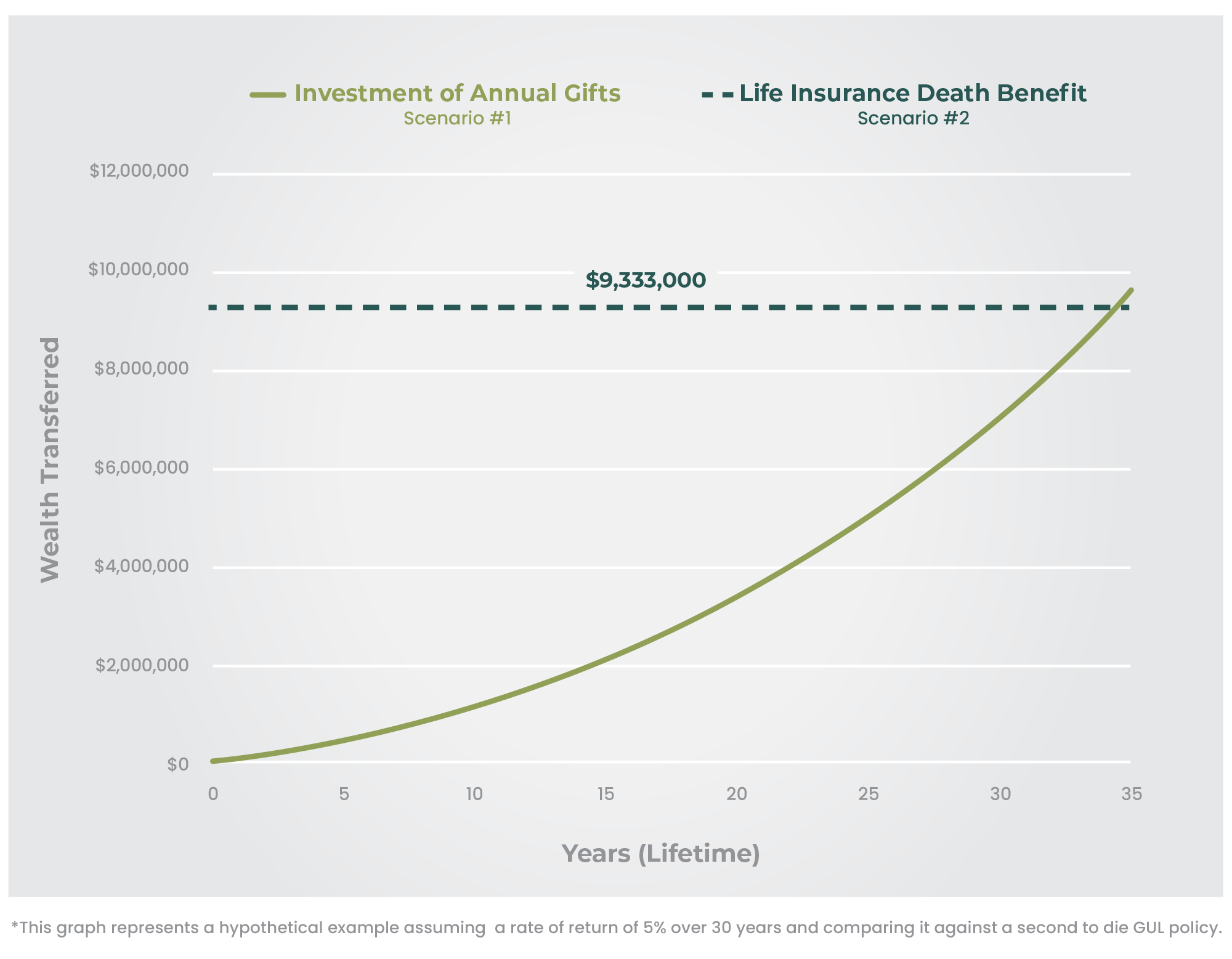

In comparing the two strategies, while the amount of the annual gift is the same, the two strategies have different advantages. In the first scenario where the gifts are invested, the amount of wealth in the trust at the end of the 30 years could vary depending on market performance. On the other hand, in scenario two where the gifts are used to purchase life insurance on the lives of the grantors, the $9,333,000 death benefit is locked in from the moment the insurance is issued after the first annual payment and the benefit is guaranteed to age 121.

As you can see from the exhibit above, both strategies are an effective way to transfer wealth in a tax efficient manner.

Additional Benefits of using an Irrevocable Trust:

- Annual exclusion gifts help minimize or eliminate estate taxes

- Gifts made to trust help avoid probate

- Asset protection

- Creates intergenerational wealth

- Assets are out of your children’s marital estate for divorce purposes

Conclusion

The annual gift tax exclusion can be one of the most powerful estate planning tools, you just need to be intentional about using it every year. It doesn’t have to be complicated, but it must get done before December 31st. Developing and implementing a gifting strategy for wealth transfer should be part of everyone’s estate plan. If you have questions about your planning or would like a second opinion, Let the Legacy Group help you navigate and explore your options. Email us at LegacyGroupNY@financialguide.com

Key Takeaways and Considerations

- “Use it or Lose it” – Annual Exclusion Gifts must be made before December 31st

- No I.R.S. forms need to be filed if gifts are under the annual exclusion threshold, unless electing to gift split

- Annual exclusion gifts must be unrestricting and made available immediately to recipients

- Gifts made to trust must be accompanied by a Crummey letter/notice

Contact the Legacy Group and let us help you find the right strategy that suits your needs. Email us at LegacyGroupNY@financialguide.com

—

Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC. Member SIPC. The Legacy Group is not a subsidiary or affiliate of MML Investors Services, LLC, or its affiliated companies. [6800 Jericho Turnpike. Suite 202 W Syosset, NY 11791 (516) 364-4203. Neither MML Investors Services, LLC [or MM if appropriate] nor any of its subsidiaries, employees or representatives are authorized to give legal or tax advice. Estate Planning services are provided working in conjunction with your Estate Planning Attorney, Tax Attorney and/or CPA. Consult them for specific advice on legal and tax matters. CRN202511-3305984